Let’s say you have the chance to buy a government bond that’s capital protected — meaning you’ll get your original investment back at maturity, no matter what happens in the meantime (note: although perhaps uncommon in general these specific kinds of bonds are actually quite common in the UK for example). Sounds comforting, right?

Now imagine three different versions of this bond:

- Scenario A: Pays +5% interest, inflation is 10%.

- Scenario B: Pays 0% interest, inflation is 5%.

- Scenario C: Pays -5% interest, inflation is 0%.

In each of these cases, your real return is -5% per year. That means your purchasing power shrinks by 5% annually, no matter which scenario you’re in.

But psychologically, they all feel very different — and that’s where it gets interesting.

Let’s Break Them Down

| Scenario | Interest | Inflation | Real Return | How It Feels |

|---|---|---|---|---|

| A | +5% | 10% | -5% | Comfortable — you get income, capital looks untouched |

| B | 0% | 5% | -5% | Less comfortable — you must sell part of your capital |

| C | -5% | 0% | -5% | Uncomfortable — you see losses with no inflation excuse |

Even though the real economic outcome is the same in all three — you’re getting poorer by 5% annually — the way those losses are framed and experienced creates a very different emotional response.

The Illusion of Income (Scenario A)

In Scenario A, you’re earning visible income — $500 a year on a $10,000 bond — even though inflation is silently reducing your purchasing power. Your balance stays flat, you feel like you’re gaining, and the loss is hidden.

This is why investors tend to prefer interest-paying assets. They feel rewarding, even when they’re not.

Selling Principal (Scenario B)

In Scenario B, you get no interest, so to generate income, you have to sell a slice of your bond each year. Over time, your balance declines — and it feels like you’re spending your savings, even though the real return is no worse than in Scenario A.

This feels uncomfortable because we’re psychologically averse to reducing our visible capital, even if it’s rational to do so.

Nominal Loss, No Inflation (Scenario C)

Scenario C is perhaps the most unsettling. You’re actually losing money on paper each year — 5% of your investment disappears — but there’s no inflation to blame. Your balance drops, and there’s no income at all.

This is what people think of as a “bad investment” — even though in real terms, it’s exactly the same as A and B.

This Isn’t Just a Thought Experiment

These examples may sound extreme, but here’s the thing: they may already reflect reality — just not in the way it’s officially reported.

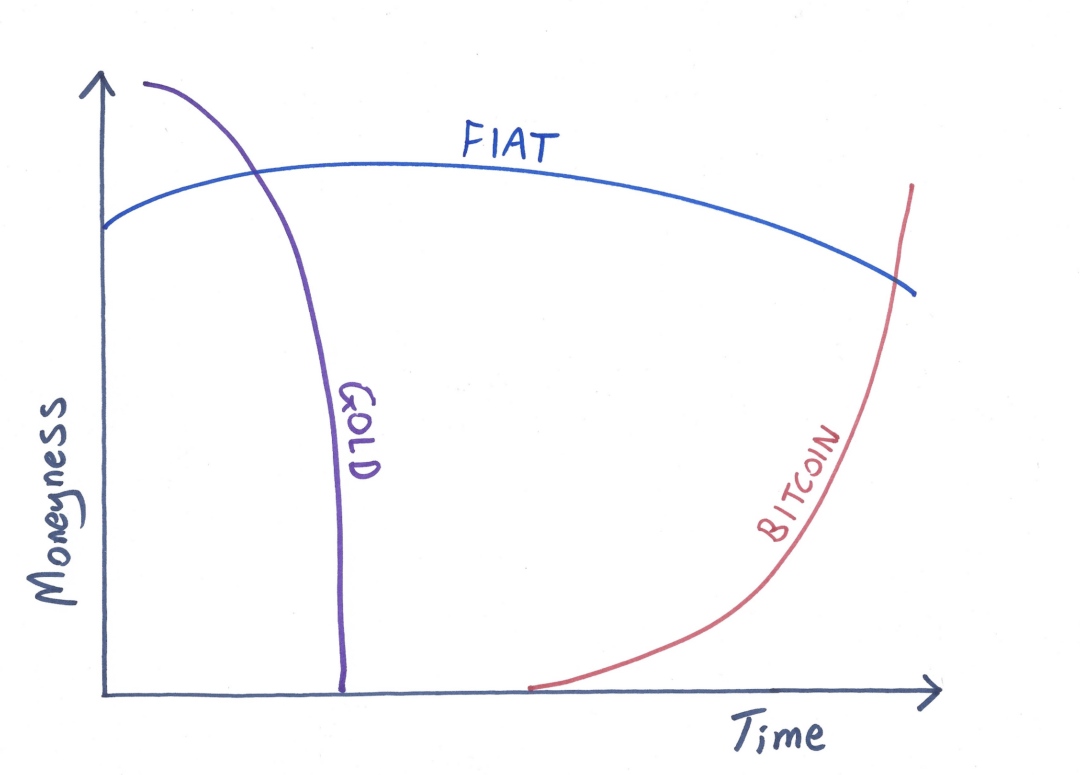

Governments tend to understate inflation. According to ShadowStats, which tracks inflation using pre-1990s U.S. government methodology, real inflation could be much higher than the numbers reported today.

So if you’re earning 5% on a bond and the government says inflation is 2%, it may look like you’re gaining. But if actual inflation is more like 7–10%, you’re actually losing — putting you closer to Scenario A than you think.

This makes our scenarios not just plausible, but potentially current.

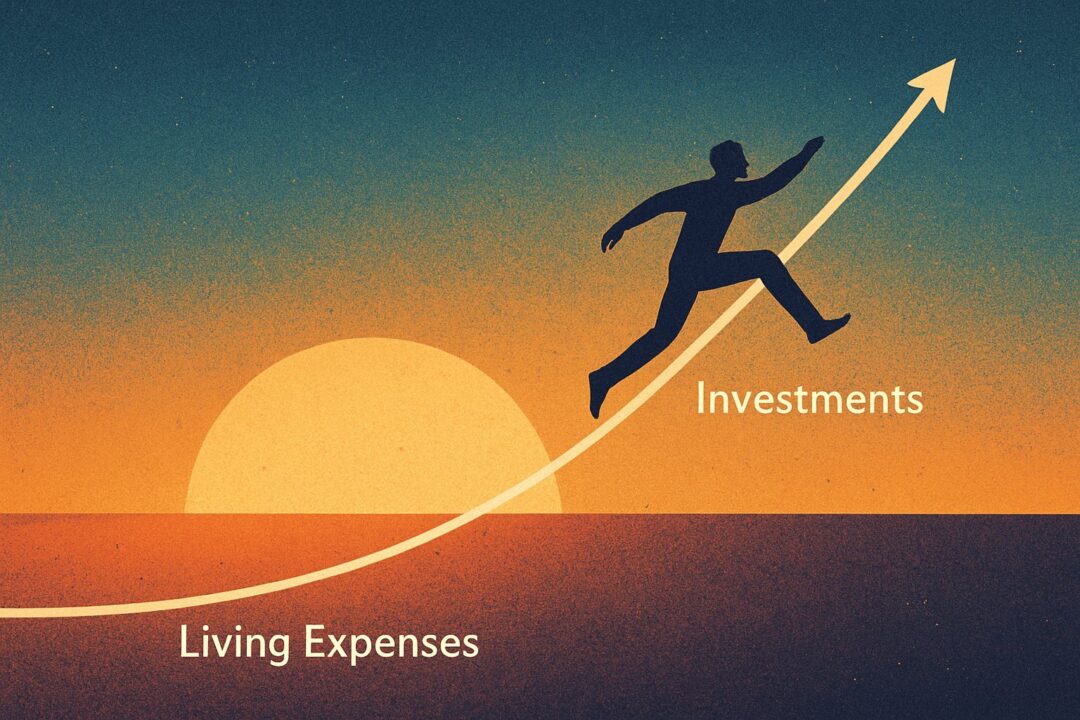

Capital Protection vs. Purchasing Power

These bonds may be capital protected — meaning your $10,000 will be returned in full when the bond matures. But if you’re losing 5% a year then after ten years that $10,000 could only buy what approximately $6,000 (or slightly less) would today.

In real terms, you’re still losing — just less visibly.

So What’s the Takeaway?

In all three scenarios, the real loss is the same. But the emotional experience is not:

- Scenario A feels the safest, even though it’s quietly destroying your wealth.

- Scenario B feels riskier, because you have to sell capital — even though the math is the same.

- Scenario C feels the worst, because losses are in your face and can’t be blamed on inflation.

Real returns matter, but how those returns are presented and perceived can drastically alter investor behavior.

The truth is: what feels safe may not be, and what feels risky may just be emotionally difficult.

Final Thought

If your financial strategy is based only on what you see — such as interest payments or stable account balances — you might be falling for the oldest trick in the book: nominal comfort hiding real loss.

Invest with your eyes open, not just your gut (and make your own calculations – without just mindlessly believing government inflation numbers).

Discover more from Brin Wilson...

Subscribe to get the latest posts sent to your email.