Inflation isn’t just an economic statistic. It’s not a neutral figure buried in news headlines or government reports. It is, in practice, a relentless force that strips wealth from the poor and delivers it to the rich — quietly, steadily, and with devastating efficiency.

Every year, as prices rise and currency loses value, millions of working people are pushed closer to the edge. Not because they’re lazy, not because they’re irresponsible — but because the system is designed this way.

The Poor Don’t Get to Play the Game

Inflation hits hardest where it hurts most: food, rent, transportation, utilities. The basics. For the poor, there is no “disposable income” — every cent is spoken for. There is no cushion to fall back on, no portfolio to balance out losses. Just a rising cost of survival.

They can’t save. They can’t invest. Many are already in debt, and as inflation rises, so do the costs of borrowing. Every dollar they earn loses value over time, and every dollar they owe becomes more profitable for their lender.

Meanwhile, the rich? They hold assets. Assets that inflate with inflation — real estate, stocks, commodities, businesses. They don’t just survive inflation. They thrive on it.

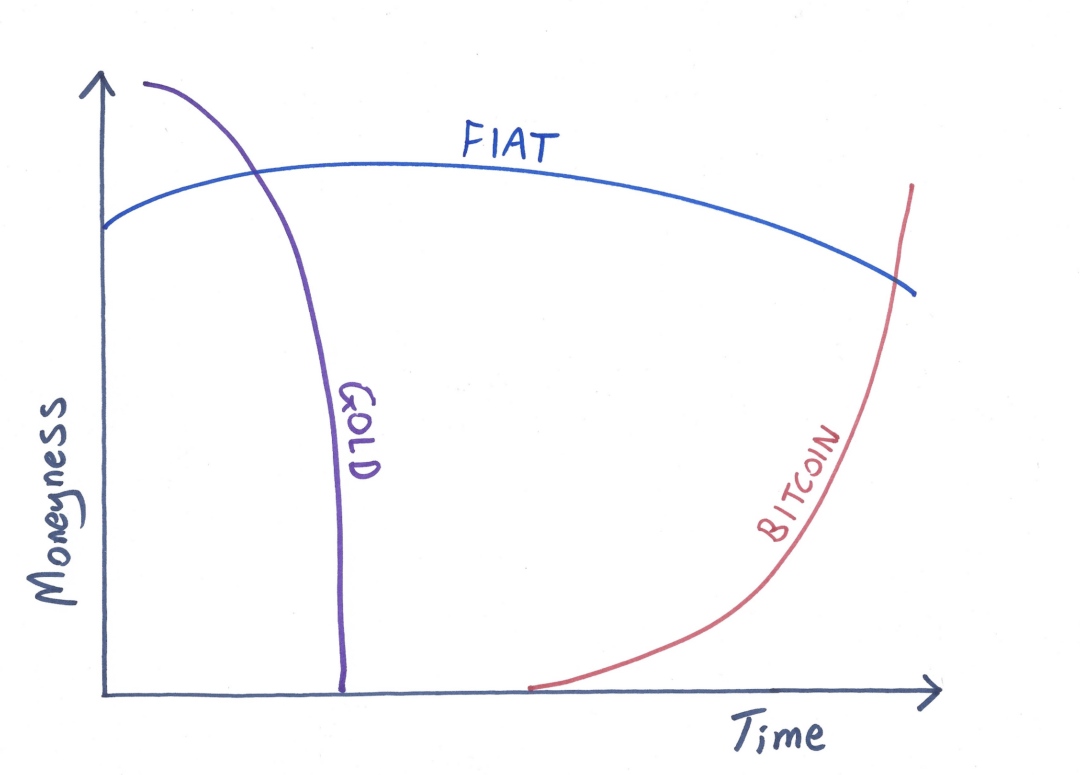

The Cantillon Effect: Money Enters at the Top

When governments or central banks flood the system with new money — through stimulus, bailouts, or debt-funded spending — it doesn’t trickle down. It floods upward.

New money enters the economy through the hands of banks, corporations, and financial markets — not through wage increases or direct relief. This is the Cantillon Effect in action: those closest to the money printer benefit first. They spend and invest before prices adjust. By the time that money filters down to the poor — if it ever does — it’s already devalued.

So the rich buy assets early, then watch prices rise. The poor get the leftovers — higher rents, more expensive groceries, and stagnant wages.

Government Waste, National Debt, and the Illusion of Help

Politicians love to talk about helping “working families” — but the reality is that much of government spending doesn’t trickle to the poor. It’s swallowed by bloated bureaucracies, siphoned into inefficient programs, or handed to contractors and corporations with political connections.

And when spending outpaces tax revenue? The government borrows — more debt, more stimulus, more money printing.

Which means… more inflation.

The very policies sold as relief often accelerate the cycle of wealth extraction — masking the long-term consequences with short-term fixes.

Inflation Is a Hidden Tax — But Only the Poor Pay It

Inflation is often called a hidden tax, and that’s exactly what it is — a tax on holding cash. But here’s the kicker: only the poor hold cash. The rich hold assets.

The working class sees their savings eroded, their purchasing power gutted, their dreams of stability pushed further away. The rich see their wealth rise with inflation, often leveraging borrowed money at ultra-low interest rates to accelerate the growth.

It’s not just a gap. It’s a chasm — and it’s widening.

This Is the Engine of Inequality

This isn’t a glitch in the system. It is the system. Inflation, driven by loose monetary policy and government overreach, is a core driver of snowballing inequality. It’s a silent force that extracts from the bottom and compounds at the top.

Until we confront this — not with slogans, but with systemic reform — the divide will only deepen.

The poor will keep running on a treadmill that moves faster every year, while the rich ride escalators to the penthouse.

And the worst part? Most people still think the system is fair.

Discover more from Brin Wilson...

Subscribe to get the latest posts sent to your email.